The Banking, Insurance, and Financial Services team at Tyler Wren have been working to put together our 2022-23 Risk and Compliance salary guide. The salary guide consists of market research and data collated from clients and candidates across the Banking, Insurance and Financial Services industries.

I have used this article to outline critical findings from a recent salary survey that will benefit both candidates and clients. With the ‘usual’ workplace changing over the past few years with employees having to spend a lot of time at home, counter offers becoming more common, and salary adjustments as retention motivators for employees, this has made the market even tighter and essentially an employees market.

To collate data for this salary guide, we gathered information from individuals from various firms across New Zealand, such as

- 30% ‘Big 4’ banking institutions

- 28% Mid level firms

- 25% Large firms/big corporates

- 8% Big 4 professional services

- 9% of Small firms

What are employees looking for from a company?

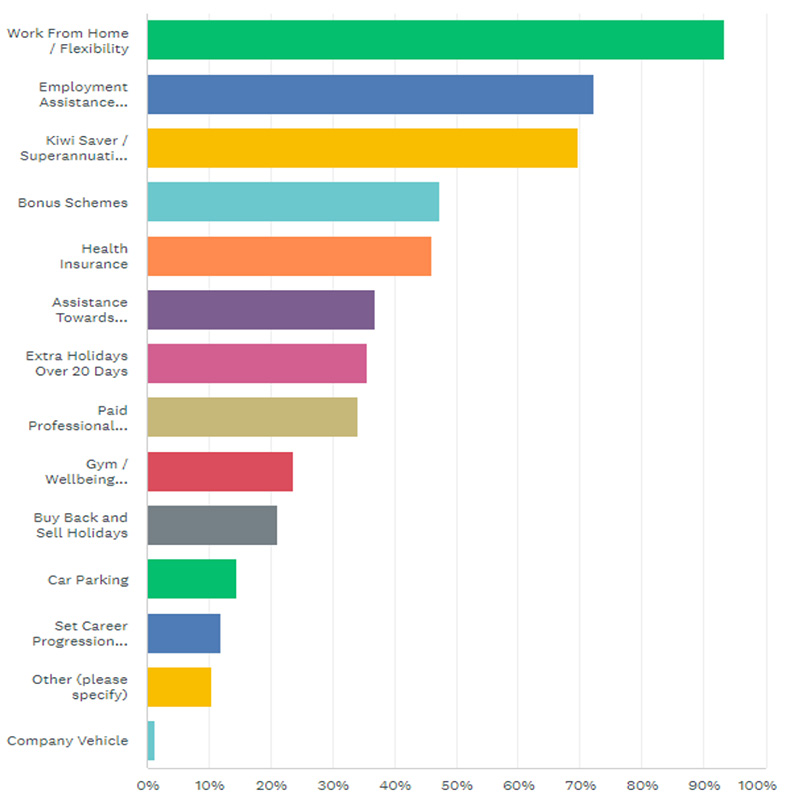

We asked our survey participants to choose the benefits that are important to them. Unsurprisingly, work-from-home/flexibility took the top spot, with 94% of people stating this is the most crucial benefit. We have seen many roles turned down due to the little flexibility offered by companies. However, people want to keep this flexibility option, which came about due to working from home during covid periods.

The survey results also show employment assistance, KiwiSaver, and bonus schemes all deemed as essential benefits to the employee.

Salary increases and how this has looked over the past 12 months

With the pandemic, risk and compliance salaries were rising incrementally before the first lockdowns. As a result, we noticed a considerable rise in wages across all roles, resulting in people moving around the market for significant increases in remuneration. Employers had to negotiate base salaries at the top of allocated salary bandings. However, things have settled down with these increases between 2019-2020. With the market navigating the pandemic, employee salary increases have slowly increased to the pre-pandemic levels.

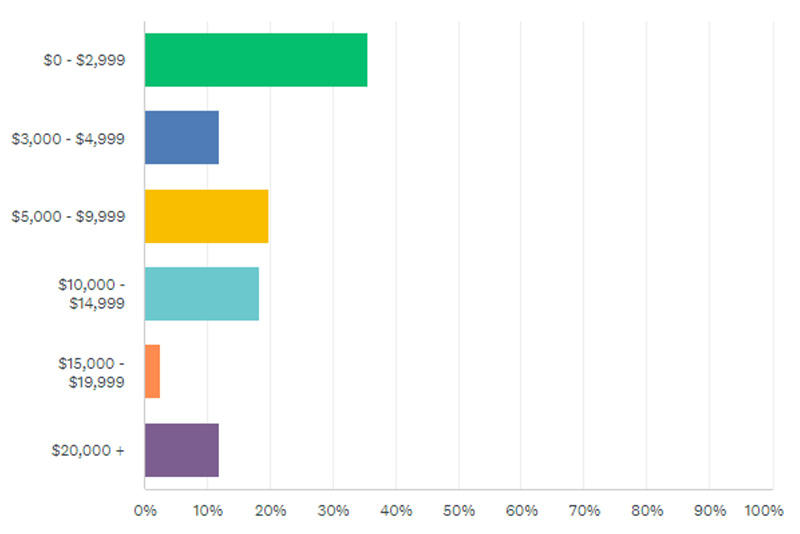

As the salary survey shows, 35% of people said their salary increased from just 0- $2,999 over the past 12 months. A rise of around 2-3%, below the average annual salary increase.

We expected that going into 2021-22, salary increases would be under pressure, and people would be frustrated, resulting in further movement around the market. However, employers have also focused on improving and refreshing their overall benefits offering to retain and attract staff, considering well-being benefits and variable rewards as examples.

Are you interested in discussing opportunities within Risk & Compliance? Please do reach out for a confidential chat with our team.

The Risk and Compliance salary guide’s available now

The Risk & Compliance Salary Guide covers financial crime, Internal Audit, Operational Risk, Governance and Compliance. Please follow this link to receive a copy of the 2022-2023 salary guide.

Here at Tyler Wren, we know good people know good people. If you refer someone to Tyler Wren, whom we secure a new role for, we offer a voucher of *$600. Click here to refer a friend