Whether you have gained your CA qualification, are currently working towards your CA, or have clicked on this CAANZ article because you need clarification, direction, or more information, then read below to go from 😖 to 😀💡.

CAANZ – Let’s Break It Down:

Chartered Accountants Australia and New Zealand (CA) are one of the post-uni qualifications encouraged in the accounting profession for those who want to develop their careers further and open up future opportunities. This recognised qualification can allow you to work internationally, expand salary bands, expedite your career and open up more specialised firms and job opportunities for you in the future.

Do you need your CA qualification to get an accounting job?

No – but many firms prefer their staff to have or be studying towards this qualification, but you can also become ‘qualified by the experience’ gained in your career.

Do you need your CA to work at Big Four or Mid Tier firms?

Ideally – with exceptions – most international or national firms want their staff to be CA-qualified or working towards this qualification due to the high net worth clients they are working with.

CAANZ – Who, What, When, Where, Why, and How?:

Chartered Accountants have that ‘extra level’ of knowledge and education to help businesses and clients grow and prosper. The CAANZ program aims to provide its people and their employers with the protection of the brand, to connect and inform, support future talent and to promote and recognise professional and ethical standards.

Who –

CAANZ is a professional body that accountants will need to register with to complete this qualification, gain career pathway knowledge and direction, and ongoing training, education, and support. Anyone with a CAANZ accredited degree (Level 7 or higher) can register to complete this qualification. If you have an international qualification, there are career pathways set by CAANZ to help convert your qualification or direct you through the additional courses to gain your NZ equivalency.

What –

When you register with CAANZ, you officially become a ‘provisional member’, indicating to future employers that you are studying towards this qualification. The CA qualification itself is split into practical and module work. The qualification aims to combine work with study, so the practical work is completed whilst working with an accredited employer (ATE). The study modules are completed outside of work with the employer’s support, leave allowances, and mentorship to help create a streamlined and unproblematic process that benefits both the employer and the employee.

When –

You can register and begin your CA pathway at any point during your career. However, the earlier you gain your CA qualification, the earlier international firms, specialised roles, unique experiences, exposure opportunities, and widened salary bands become more available.

Where –

Many choose to begin their CA straight out of university, but this also depends on the place of work and whether they are working with an accredited employer that can support this process. Many accountants will pursue an ATE only to ensure they can gain their CA qualification as soon as possible. Still, others will choose to do this later in their career and gain hands-on experience first.

Why –

Apart from the mentioned benefits such as higher salaries, international options, career/firm/job opportunities, career development, and larger and more varied client exposure, it is a chance to qualify with the guidance and support of your employer. At an ATE firm, they offer mentoring, training, and first-hand exposure experiences for those studying toward their CA. This enables you to complete the practical work for your qualification alongside an employer who can guide you with their invaluable knowledge and experiences.

Furthermore, for the modules and exams, most employers provide you with a pre-approved study leave to allow you the support and time you need to complete your studies – without the pressure and stress of balancing a study and work life. For employers, the learning flexibility and exam timetable help reduce resourcing strains, providing a more targeted knowledge base to provisional accountants to help them navigate the ‘here and now scenarios in the workplace.

How –

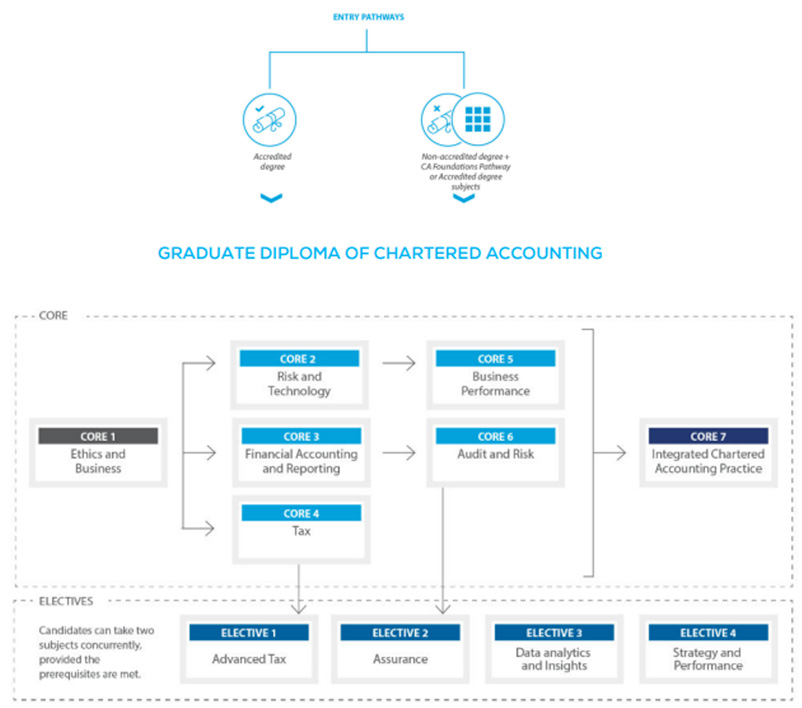

The CA qualification has recently undergone a structural change due to technological and digital advancement allowing for a more future-driven approach to accounting. The new CA program refocuses on creating Chartered Accountants who are ethical and trusted partners, collaborators and communicators, critical thinkers and problem solvers, and adaptive, reflective professionals. This is split into four areas of focus to help accountants apply their knowledge to relevant and realistic scenarios:

- Technical/Professional Expertise – tax, financial planning, superannuation, audit and assurance, insolvency, corporate finance, and reporting

- Personal Mindset/Intellect – ethics and integrity, critical thinking and judgment, adaptive mindset, self-management and learning, and regard for others

- Business Context – communication, collaboration and relationships, problem-solving and decision-making, customer focus, digital fluency, and data analysis

- Leadership – People & Future – agility and change, leading others, driving results, future focus, innovation, governance, and risk

Furthermore, the new CA program allows for a more supportive applicant entry and flexible journey, encourages engaging and experimental learning, and creates more streamlined and rigorous assessments:

- Supporting diverse educational backgrounds, defining knowledge requirements, and filling knowledge gaps with a 2-week introductory experience that outlines the CA program

- Providing a more flexible timetable with more core subject availability, two elective options, virtual and in-person collaboration sessions, and concurrent study

- Realist case studies and challenges, varied digital resources, multidisciplinary subjects, and the incorporation of communication, collaboration, and ethics

- Digital exams, academic integrity with updated policies and procedures, authentic-based exams, and assessment standards

Are you considering changing firms, but you are bonded to your current firm?

If you are part way through your CA qualification and are being supported by your current firm – the likelihood is that they have bonded you for a period of time, due to the fees involved. However, this can hinder people from considering moving firms – do not worry!

When you transfer CA firms, it is common for the new firm to either pay back the old firm directly for the fees they have paid towards your CA studies or to reimburse you for paying the fees back to your old firm

This is a common occurrence in the CA world!

More Information:

Please follow the below links for more information and frequently asked questions.

- https://www.charteredaccountantsanz.com/-/media/2cdd5cb7a6d2411c898b39b8ed78fa67.ashx

- https://www.charteredaccountantsanz.com/-/media/47a8b556dc27461b98e4b519b6be2d76.ashx

- https://www.charteredaccountantsanz.com/-/media/f27526abce3c4cb1ba7d050ec9779862.ashx

- https://www.charteredaccountantsanz.com/-/media/ec0cd57e997d48e9ba17308f947ad11b.ashx

So What Does This Mean For Me?

Get in touch for a confidential chat to help you better understand and be able to utilise the current market – reach out to discuss how we can help you today or in the future!

Jaz Locke | 03 260 5103 | jlocke@tylerwren.co.nz